IRA Regulatory Toolkit

A library of resources to support stakeholder decisions as they apply IRA opportunities in regulatory proceedings.

Landscape Overview

What IRA opportunities exist for advocates and other stakeholders to engage in regulatory proceedings?

The IRA offers utilities three main funding and financing avenues to enhance customer benefits:

- Tax Credits that significantly improve the economics of clean energy investments

- Department of Energy (DOE) Loan Programs that provide access to low-cost capital for clean energy projects

- Department of Agriculture (USDA) New ERA Programs that provide financing support for rural electric cooperatives

As they utilize these IRA opportunities, utilities can leverage cross-cutting planning to maximize customer benefits and enhance equity, for instance by rigorously pursuing:

- Community Benefit Plans, which are required for many federal funding applications; and

- Clean Repowering, which is a strategy to overcome interconnection challenges and accelerate renewables deployment by reutilizing existing points of grid access, thereby enabling faster realization of IRA incentive savings

Tax Credits

Four notable ways the IRA makes important changes to the federal tax credits that incentivize clean energy include:

- Extending and expanding the Production Tax Credit (PTC) and Investment Tax Credit (ITC)

- Creating bonus adders for the PTC and ITC

- Allowing regulated utilities to opt out of normalization for the ITC when it is used for storage

- Easing monetization through new transferability and direct pay mechanisms

Extending and expanding the PTC and ITC

The IRA extends PTC and ITC eligibility in full through at least 2033, providing long-term certainty to investors and developers who want to utilize these tax credits. It also expands the eligibility for the PTC and ITC: i) solar has been put on an even statutory footing with wind and can now use either the PTC or ITC, whereas previously only the ITC had been available; and ii) stand-alone storage is now eligible for the ITC, whereas previously a pairing with an ITC-eligible generation asset had been required. For utility-scale solar projects with high capacity factors, the newly available option to claim the PTC is likely to provide larger financial benefits than the ITC.

Bonus adders

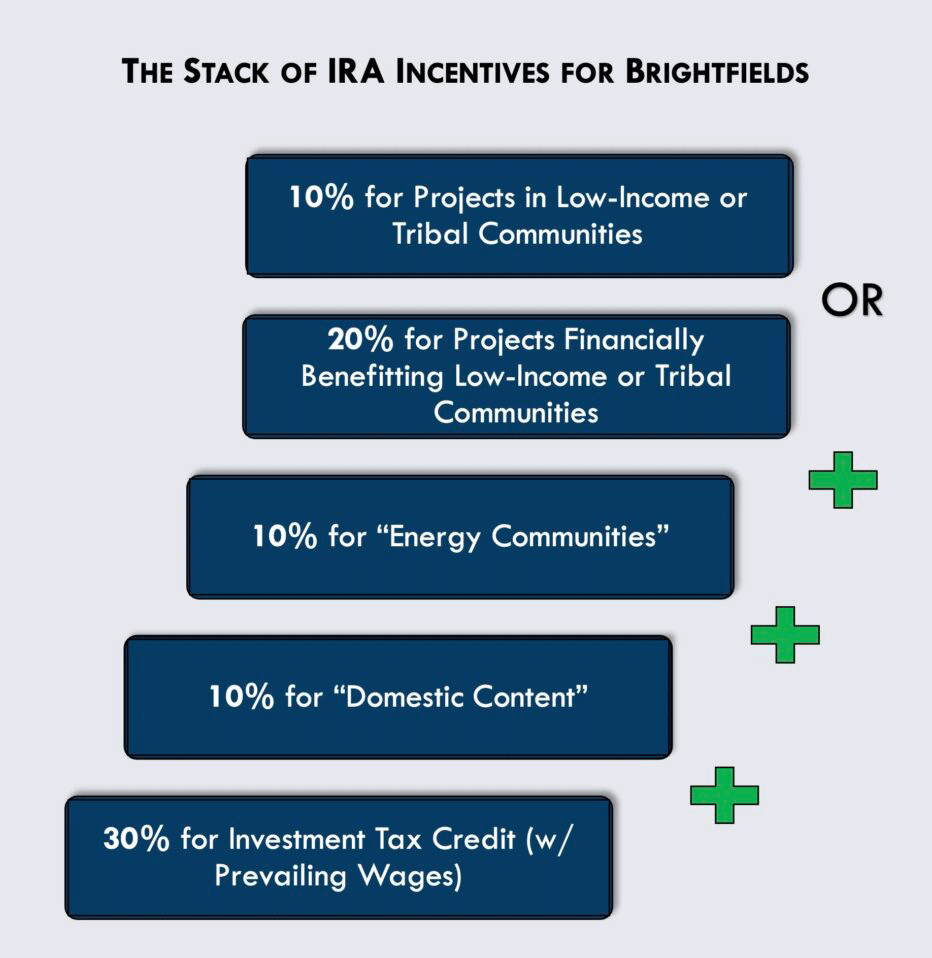

The IRA also includes bonuses of up to 10% for the PTC and 10 percentage points for the ITC. Bonuses are separately available for projects located in an energy community (largely communities with retired coal plants and coal mines or with large fossil fuel-based employment) and for projects using prescribed amounts of domestically produced materials. These bonuses are stackable, enabling a PTC of up to $36/MWh (in 2024 dollars) or an ITC of up to 50%. There are additional ITC bonuses for solar and wind energy projects that have a maximum net output of less than 5 MW and that address income equity concerns; these bonuses must be applied for and, if awarded by the Department of the Treasury and the Internal Revenue Service, provide a 10 percentage point credit for projects in low-income communities or on federal Tribal land OR a 20 percentage point credit for projects that are part of a qualified low-income residential building or low-income economic benefit project.

Exhibit 1

Notes:

- Low-income/Tribal community adders are for projects no larger than 5 MW and are capped at 1.8 GW annually.

- The PTC pyramid starts at $30/MWh for projects paying prevailing wages, as inflation-adjusted for 2024. Domestic content and energy community adders stack on top, with 10% for each bonus achieved. Credit is earned for 10 years based on output sold. Low-income/Tribal adders do not apply for the PTC.

Addressing the ITC Normalization Issue

Prior to the IRA, tax rules required regulated utilities to keep some of the financial benefit of the ITC exclusively for shareholders. The IRA effectively eliminated this requirement in two ways. First, by allowing PTCs for all clean energy generation resources, including solar; the PTC is not subject to normalization. And second, by giving regulated utilities the chance to opt-out of normalization for the ITC for storage projects specifically. RMI analysis has found that this opt-out can provide an additional 15% savings for ratepayers.

Transferability and direct pay:

Most investor-owned utilities do not have sufficient taxable income (i.e., tax capacity) to efficiently self-monetize tax credits, especially front-loaded ITCs. Tax credits reduce taxes, as calculated on taxable income, on a dollar-for-dollar basis. Prior to the IRA, tax credit recipients that lacked sufficient tax capacity needed to carry unused credits forward for potential future use. Carrying the credits forward reduces their present value as a function of the time value of money. Nonprofit utilities like rural electric cooperatives (co-ops) operate on a not-for-profit basis and effectively have no tax capacity. Municipal utilities (munis), as government entities, are not subject to taxation.

Utilities, co-ops, and munis often couldn't use clean energy tax credits themselves before the IRA because they lacked sufficient tax capacity. Instead, they had to rely on third-party developers who could monetize the credits. These developers used tax equity structures to gather tax capacity from corporations with large tax bills, allowing them to pass along some of the incentive value to the contracted energy off-takers. A few investor-owned utilities partnered directly with tax equity investors, but from the ratepayer perspective much of the incentive value of the tax credits was still being siphoned off by other parties, leaving utilities’ bills higher than if full utility self-monetization and benefit pass-through were feasible.

The IRA includes provisions allowing for-profit utilities to transfer clean energy tax credits to other taxpayers, in effect selling them at a discount that is likely to be far smaller than the value lost to the costs of structuring tax equity partnerships and providing investment returns to tax equity investors. When combined with the normalization opt-out, transferability allows investor-owned utilities to own and price clean energy projects free of some key competitive disadvantages that were baked into the pre-IRA tax credit landscape. For their part, nonprofit utilities and munis are now eligible for direct pay, meaning they can own projects and receive cash payments in lieu of clean energy tax credits from the federal government, regardless of tax capacity.

Types of Filings and Expectations of Utility Actions

- In resource planning proceedings such as IRPs, utilities need to include these tax credits when assessing the economics of various resource portfolios.

- In CPCNs, utilities need to include these tax credits when assessing the economics of alternative portfolios that can meet the same reliability requirements as the proposed investment.

- In rate cases, utilities need to demonstrate that the cost savings enabled by these tax credits (including plausible expectations about monetization via transferability) are passed through to ratepayers.

Resources

- Read RMI’s article “The Sherco Clean Repowering: How One Community Turned a Coal Plant into a Hub for a New Clean Economy” to learn about a real-world success story of clean repowering, enabled by federal incentives, proactive community engagement, and a forward-looking state regulator.

- Read Page 65 in RMI's Planning to Harness the Inflation Reduction Act report to understand how regulators and utilities can optimize the tax credit benefits of the IRA in resource planning.

- Read the White House IRA Guidebook to understand the IRA tax incentives and investment programs, as well as each program's eligible uses, potential recipients, and other program details.

- Read RMI's IRA Program and Tax Incentive Summary to understand IRA funding programs' relevant sector, topic, funding eligibility and funding type, in addition to summaries on IRA-related tax incentives.

DOE LPO Programs

Under the IRA, the Department of Energy (DOE) offers a set of new and expanded financing opportunities to support deployment of clean energy and infrastructure, including two new loan programs under Title 17: the Energy Infrastructure Reinvestment (EIR) and State Energy Financing Institution (SEFI) programs. Title 17 programs are managed by DOE's Loan Programs Office (LPO).

The EIR is a $250 billion guaranteed federal loan program that allows for projects that “retool, repower, repurpose, or replace energy infrastructure that has ceased operation,” or “enable operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or greenhouse gases” to receive up to 80% of project costs in the form of low-cost financing from the federal government. With authority to make lending commitments through September 2026 and a $5 billion budget to buy down interest rates below the levels supported by borrowers’ credit ratings alone, the EIR represents an unprecedented (but time-limited) opportunity to secure a least-cost energy future for ratepayers across the country.

The SEFI program provides up to $40 billion in loans and loan guarantees for various manufacturing, energy, industrial, building, and transportation infrastructure projects. In order to qualify for LPO financing under the SEFI program, projects must receive meaningful financial support from a state energy financing institution.

Projects can receive up to 80% of project costs in the form of low-cost financing from the federal government. With authority to make lending commitments through September 2026 and a $5 billion budget to buy down interest rates below the levels supported by borrowers' credit ratings alone, the EIR represents an unprecedented (but time-limited) opportunity to secure a least-cost energy future for ratepayers across the country.

Types of Filings and Expectations of Utility Actions:

- In resource planning proceedings such as IRPs, utilities need to include LPO programs in planning analyses when assessing the economics of resource portfolios.

- In CPCNs, utilities need to include LPO programs when assessing the economics of alternative portfolios that can meet the same reliability requirements as the proposed investment.

- In rate cases, utilities need to demonstrate that the cost savings enabled by these programs will be passed through to ratepayers.

Resources

- Read Page 83 in RMI's Harnessing the IRA report to understand IRA's Title 17 Clean Energy Financing Program and key venues and opportunities for utilizing the EIR.

- Read DOE's EIR overview to understand the range of projects the EIR can support.

- Read DOE's SEFI overview to understand the range of projects SEFI can support.

- Read RMI's article "The Most Important Clean Energy Policy You've Never Heard About" to understand how the EIR enables reinvestments in energy communities while accelerating the energy transition.

- Read RMI's article "The Energy Infrastructure Reinvestment Program: Federal financing for an equitable, clean economy" to understand the potential of using the EIR to refinance unrecovered legacy asset costs and reinvest in new clean energy.

- Read RMI's article "Maximizing the Value of the Energy Infrastructure Reinvestment Program for Utility Customers" to understand how to structure EIR funding to maximize benefits for ratepayers through the "capital recycling" approach.

- Read RMI's EIR Playbook for States to understand the actions state governments can take to get EIR dollars, as well as examples of high-impact EIR projects.

- Read RMI's SEFI Playbook for States to understand how state governments can use SEFI to book clean energy investments.

New ERA

The IRA included several provisions exclusively intended to support rural electric co-ops as they invest in clean energy deployment. One of the biggest is the $9.7 billion Empowering Rural America (New ERA) program — the federal government’s largest investment in the rural electric system since the Rural Electrification Act was passed in 1936 as part of New Deal. Managed by the US Department of Agriculture (USDA), New ERA is designed to provides cash grants and/or loans to allow rural electric co-ops address their particular financing challenges. In September 2024, USDA announced the selection of 16 large co-ops for awards totaling more than $7.3 billion of the New ERA appropriation. These awards will help deploy 10 GW of clean energy for the benefit of co-op customers in 23 states. Further announcements of awards are expected in the coming months.

Although not all co-ops are regulated by the state public utility commissions (PUCs), more than half of the state PUCs in the United States have at least some authority over co-ops in their jurisdictions; these co-ops may go through a regulatory process for their resource plans and rate cases, creating opportunities for advocates to influence decisions.

Types of Filings and Expectations of Utility Actions

- In planning proceedings such as IRPs, co-ops that applied for New ERA need to include the funding when assessing the economics of resource portfolios.

- In CPCNs, co-ops that applied for New ERA need to include the funding when assessing the economics of alternative portfolios that can meet the same reliability requirements as the proposed investment.

- In rate cases, co-ops that applied for New ERA need to demonstrate that the cost savings enabled by the program are passed on to ratepayers/members.

Resources

- Read Page 88 in RMI's Harnessing the IRA report to understand how New ERA supports cooperative clean energy development.

- Read USDA's New ERA overview 2-pager to understand the fundaments of the New ERA program, such as program eligibility, use cases, and types of funding available through the program.

- Read RMI's article "Clean Energy Investments for Rural America Are Booming" to understand how the IRA and New ERA address legacy energy transition challenges faced by co-ops and deliver substantial economic benefits for rural America.

Clean Repowering

Clean repowering is an immediate, no-regrets opportunity to address the challenges of interconnection queues. By using the existing interconnection rights of fossil fuel assets to connect nearby renewable energy and storage resources to the grid, clean repowering could eliminate years of delays in the interconnection process. This, combined with the IRA incentives that improve the economics of clean energy, can make clean repowering especially financially attractive for both utilities and their customers.

Clean repowering can be accomplished in two ways:

- Generator replacement: A retiring power plant's interconnection rights are utilized by new clean energy resources.

- Surplus interconnection: New clean energy resources use an existing power plant's interconnection rights during periods when that plant is not operating.

RMI analysis shows that clean repowering has the potential to add 250 GW of economically viable new clean resources built at or near the sites of retiring and existing fossil fuel power plants. This could save electricity ratepayers nearly $13 billion over the next 10 years. Opportunities for clean repowering are available across the country but are especially concentrated in the Midcontinent Independent System Operator (MISO), Pennsylvania-New Jersey-Maryland Interconnection (PJM), and the Southeast.

Types of Filings and Expectations of Utility Actions

- In resource planning proceedings such as IRPs and CPCNs, utilities need to evaluate clean repowering as "no-regrets" near-term alternatives to fossil buildout.

Resources

- Read RMI's article "Clean Repowering: A Near-Term, IRA-Powered Energy Transition Accelerant" to understand the 250 GW clean repowering opportunity nationwide.

- View RMI's IRA Opportunity Map to understand the utility-by-utility estimate of savings potential from clean repowering.

- View RMI’s Clean Repowering Site Map to navigate clean repowering opportunities by technology, size in megawatts, and location (in longitude and latitude).

- View RMI's Docket Opportunity Tracker to identify the timing and potential impact (in MWs of clean repowering opportunities) in upcoming IRPs.

Community Benefits Plans

Community benefits plans (CBPs) are key requirements for many IRA programs, including the EIR and other programs overseen by DOE and USDA. CBPs are developed by project developers and community organizations to outline the community's priorities and developer's commitment to those priorities, which vary across projects and communities and often include things such as job creation, affordable housing, etc.

Regulators, advocates, and other stakeholders can play a role in helping utilities enhance their CBPs and ensure their CBPs deliver on commitments. These plans, submitted either with project proposals or after awards (depending on the program), are vital to successful implementation of the IRA's goal of combining more clean energy with enhanced energy equity.

DOE requires CBPs to detail how the project will advance four benefit areas:

- Meaningful Community and Labor Engagement

- Investment in America's Workforce

- Diversity, Equity, Inclusion, and Accessibility

- The Justice40 Initiative

Types of Filings and Expectations of Utility Actions

- In CPCNs, utilities need to assess the inclusion of community benefits in resource selection, ensuring that projects align with state and federal funding priorities and benefit impacted communities. CBPs can be used as the tool for assessment and potentially a factor in the PUC approval of new investments.

- In rate cases, utilities need to ensure that the costs of community benefit initiatives are equitably distributed and justified.

- In DSM proceedings, utilities need to evaluate how utilities' energy efficiency and demand-side management programs deliver direct benefits to disadvantaged communities. CBPs can be used as a tool for assessment.

Resources

- Read DOE's CBP overview page to understand the key policy priorities behind CBPs, as well as to access CBP templates.

- Read Page 87 in RMI's Harnessing the IRA report to understand the role of CBPs in federal funding programs and examples of specific investments and activities they can include.

- Read RMI's article "Community Benefits Plans: Driving Equitable Clean Energy Development" to learn more about the examples of what can be included in a CBP.

- Read RMI's article "How Utilities Can Mitigate Risks through Robust Community Benefits Plans" to understand how energy project risks can be mitigated through delivering a CBP that engages the community and brings tangible benefits to community members.

- Read RMI's Community Benefits Catalog to understand the connections between community benefit examples with federal funding criteria and stakeholder priorities.

- Read the example from Xcel in Minnesota (Docket Number MN 21-694 in eDocket) to see how the regulator can create requirements-like metrics (order dated Aug 6, 2024) to hold the utility accountable to specific community benefit procedures and outcomes.

Key authors: Becky Xilu Li, David Posner, Christian Fong, Erifili Draklellis, Maria Castillo